unrealized capital gains tax warren

The new proposal would tax unrealized capital gains meaning that the wealthy would no longer be able to defer tax payments on gains made each year. If you hold an asset for less than one year and sell for a capital gain the.

Taxing Unrealized Capital Gains Would Punish Investors Equities News

For context repealing the existing estate tax would reduce revenues by about 300 billion over 10 years.

. The amount youll pay in capital gains taxes depends primarily on how long you held an asset. She then unveiled a plethora of class. When a permanent income tax was.

This tax is similar to taxes that have long been supported by progressive lawmakers like Sens. Elizabeth Warren D-Mass and Ron Wyden D-Ore speak to reporters about a corporate minimum tax plan at the US. A tax on an increase in unrealized capital gains is only on the most stretched of interpretations a tax on income.

26 2021 in Washington DC. Elizabeth Warren D-Mass and Bernie Sanders I-Vt. Thats the attitude at least of some progressive lawmakers like Elizabeth Warren and Alexandria Ocasio-Cortex AOC who famously wore a dress to the Met Gala with Tax the.

Tax capital gains at ordinary income rates and raise those rates to pre-Tax Cuts and Jobs Act TCJA levels. Thus gains would be taxed at a top rate of 396 percent. Last month I accused Elizabeth Warren of being a fiscal fraud for proposing a multi-trillion dollar government takeover of healthcare.

Democrats seem to have nixed the idea of taxing returns on unsold stock and other assets favoring other ways to raise revenue as part of a nearly 2 trillion social. In 2011 superstar investor Warren Buffett made headlines not for his investment recommendations but for his opinion. Warren Buffett taxing capital income is a bad idea.

If the proposal were. Now that weve looked at what a tax on unrealized capital gains could be like its time to point out three significant. Lets assume over the.

The proposal is likely dead on arrival as it doesnt have the votes in Congress but in its present form it would levy a 20 minimum tax on all income including not just realized. An unrealized capital gains tax on corporate assets could hit those with real estate especially hard but companies with bitcoin also come to mind. Warrens 2 Cents Will Prove Costly for All The burden of taxing unrealized capital gains will fall on a vastly greater number of people than a wealth tax on the super wealthy.

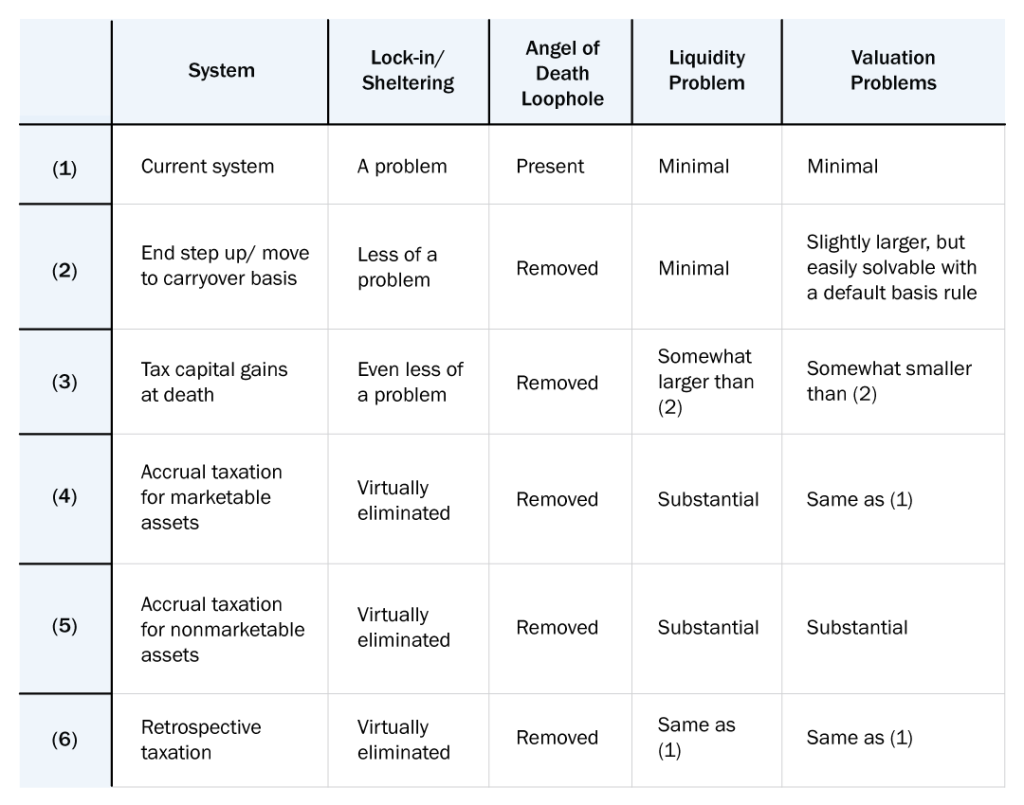

An Obama Administration plan to tax capital gains at death would have. This brings the total taxes paid on the 150 million profit to 1013 million for an effective tax rate of 68 percent and after-tax income of 487 million. The Problems With an Unrealized Capital Gains Tax.

There is a chance that Senator Warrens proposed wealth tax would be found unconstitutional but opinions are mixed and the precedents go both ways. 6 hours agoA large share of extreme wealth is held in the form of unrealized capital gains meaning investment income on which these families have yet to pay tax and may never pay.

Elizabeth Warren S Tax Plan Would Bring Rates Over 100 For Some Wsj

Short Term And Long Term Capital Gains Tax Rates By Income

How Warren Could Get A Wealth Tax Past The U S Supreme Court

Unrealized Capital Gains Tax Explained

Warren S Wealth Tax The Return Of Feudalism The Capital Note National Review

Elizabeth Warren Has A Point About Taxing Wealth Bloomberg

Elizabeth Warren Slams Elon Musk Over Taxes National Review

Biden S Plan Will Stop Billionaires From Avoiding Taxes Fortune

Manchin Pans Biden S Proposed Tax On Unrealized Gains Of Wealthy Bloomberg

High Class Problem Large Realized Capital Gains Montag Wealth

Serge Egelman On Twitter If You Can Use Unrealized Capital Gains As Collateral For A Loan A Reasonable Person Should Conclude That Those Gains Have Effectively Been Realized This Is An Area

Democrats Appear To Back Down From Unrealized Capital Gains Tax The Daily Wire

A Fiscal Analysis Of Elizabeth Warren S Medicare For All Plan By Avik Roy Freopp Org

Estate Tax Gift Tax Learn More About Estate And Gift Taxes

Billionaire Investor Mark Cuban Slams Elizabeth Warren For Demonizing The Wealthy Fox Business

Will The Unrealized Capital Gains Tax Proposal Apply To Most Investors The Motley Fool

Senate Democrats To Crack Down On Capital Gains Tax At Death

What The Wyden Proposed Tax On Unrealized Capital Gains May Mean For You